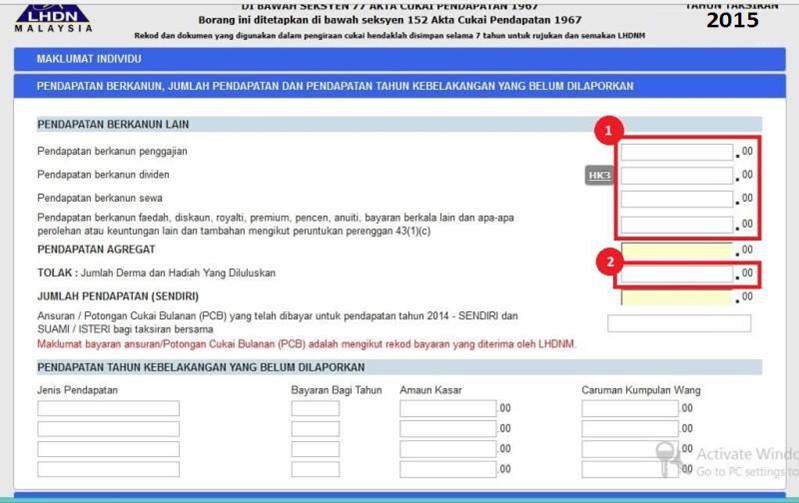

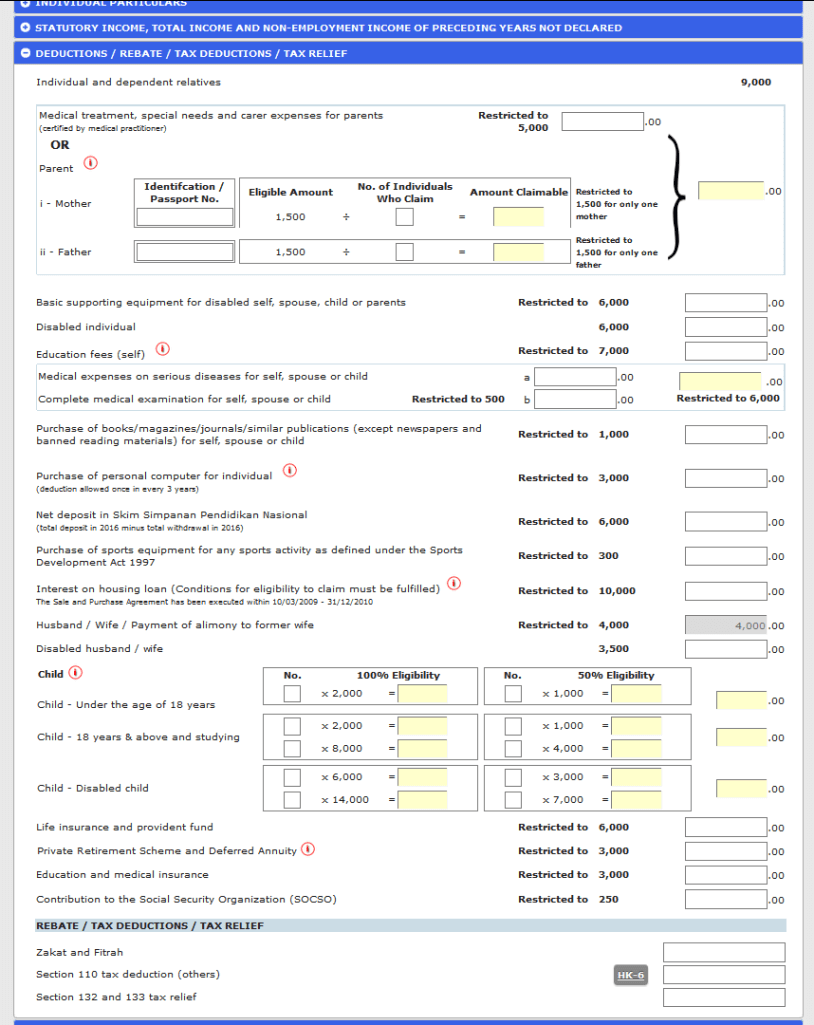

Generally tax reliefs are portions of your income that do not need to be included in the calculation of your taxes. The Inland Revenue Board LHDN said the.

How To Step By Step Income Tax E Filing Guide Imoney

1-800-88-5436 LHDN Press 1 Malay.

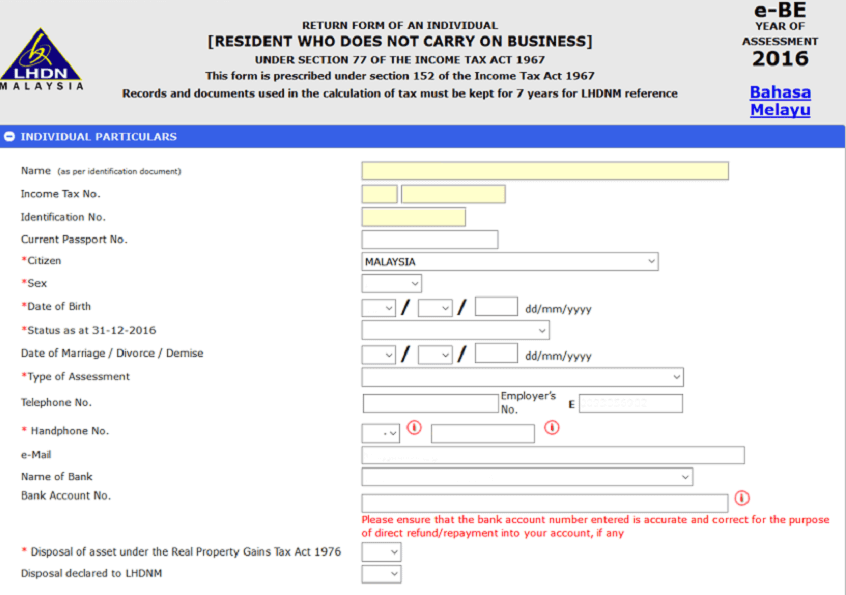

. You can learn how to file your income tax in Malaysia using LHDN e-filing with our complete guide and get the latest list of official tax reliefs for YA2021. 5 httpsmaklumbalaspelangganhasilgovmyMaklum Balasen-us C. You can find the full list of different forms on the LHDN website here.

Lhdn officially announced the deadline for filing income tax in 2021 attached is a guide to tax filing online everydayonsales com news. Anda boleh akses e-Filing LHDN dengan. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8.

If this is your first time filing your tax through e-Filing dont worry. Notification of New Employee Form CP22 Pin12021 This form can be downloaded and submitted to Lembaga Hasil Dalam Negeri Malaysia. M-Filing User Guide e-Filing FAQ Prefill Data FAQ.

After all if you as an employer fail to deduct andor remit payment by the 15th of the following month you can be fined RM 200 20000 or given 6 months imprisonment or both. Bergantung kepada pengurus website LHDN url diatas mungkin akan berubah dari masa ke semasa. E 2020 Explanatory Guide Notes.

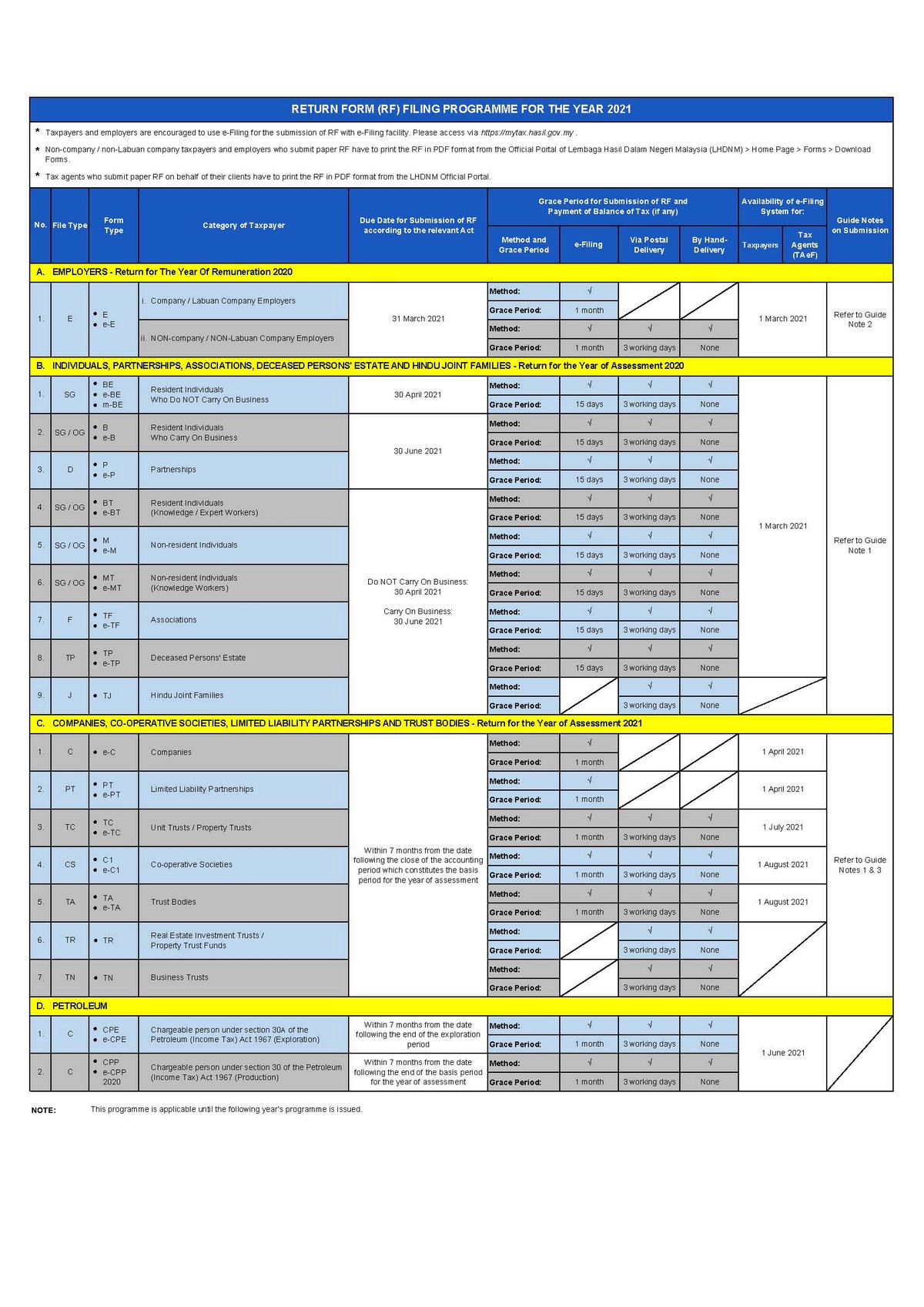

Specifically these deadlines are for taxpayers who do not carry on business filing their taxes for Year of Assessment 2021 YA2021. Basically it is a tax return form informing the IRB LHDN of the list of employee income information and number of employees it must be submitted by March 31 of each year. Oleh itu lebih baik gunakan fungsi carian google.

RinggitPlus Malaysia Personal Income Tax Guide 2020. M-Filing User Guide e-Filing FAQ. Please contact the nearest IRBM branch for your e-Filing consultation.

CompareHero 7 Tax Exemptions in Malaysia to know about. If you are unclear about CP8D form you may refer to the updated guide created by LHDN below. The Inland Revenue Board LHDN has reminded the public that the tax filing deadline for this year is set on 30 April 2022 manual submissions and 15 May 2022 e-Filing submissions.

E-Filing Prefill Data Login Prefill e-Data e-Filling RPGT e-Form Login WHT e-Form Login e-Lodgement CKHT e-Form Login. Once you have submitted the form to LHDN and a copy to your employer your employer will have to remit the amount deducted to Inland Revenue Board Malaysia IRBM also known as LHDN every month in accordance with Income Tax Deduction and Remuneration Rules 1994. Will IRBM provide extension of time for the.

This form can be downloaded and submitted to Lembaga Hasil Dalam Negeri Malaysia. For the BE form resident individuals who do not carry on business the deadline falls on either 30 April 2022 manual filing or 15 May 2022 e-Filing. Select Accounts Banking then select Bill Payment.

F O R M S No. INLAND REVENUE BOARD OF MALAYSIA E-Filing Service Counter To assist taxpayers especially on e-Filing service IRBM has opened an e-Filing service counter at every branch nationwide. LoanStreetmy 9 Things to know when Doing 2019 Income Tax E-Filing.

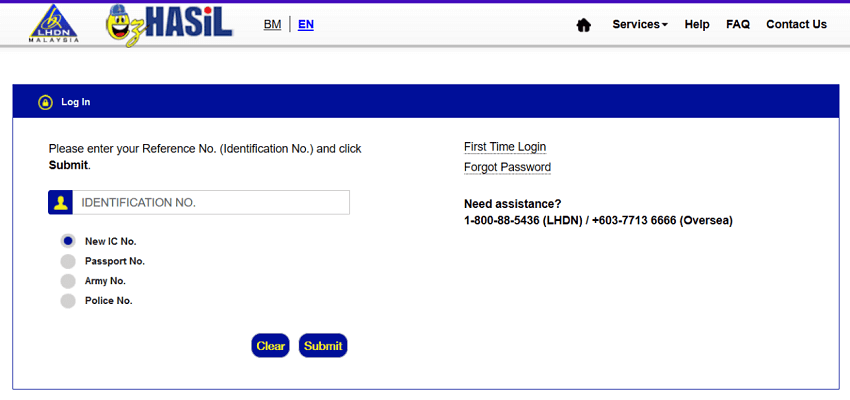

Guide To Using LHDN e-Filing To File Your Income Tax. IMoney Income Tax Relief for YA 2018. E - Filing Tax Agent First Time Login Login Download CP55 CP55A.

FORM CP22 Description Form Type Notes. Guna Google search untuk kata kunci ehasil ezHASiL atau LHDN. Those who have received their income tax return ea form can do this on the ezhasil portal by logging in or.

RinggitPlus Everything you should claim as Income Tax Relief. Do take note that tax residents enjoy certain tax reliefs and rebates. 1 Akses ke laman web e-Filing ezHASiL.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Types of e-Filing user New User First Time User need to register Digital Certificate to obtain digital signature Users with VALID Digital Certificates within 3 years Login e- Form Users with INVALID Digital Certificates more than 3. The Inland Revenue Board has advised those filing their tax returns to use the guide on its website or helplines that it is providing.

How to make a LHDN payment. Form E Borang E is a form that an employer must complete and submit to the Internal Revenue Board of Malaysia IBRM or Lembaga Hasil Dalam Negeri LHDN. This is the most important step to carry out.

Filing your tax through e-Filing also gives you more time to file your taxes as opposed to the traditional method of filing where the deadline is usually on April 30. But do you know how to pay PCB through to Lembaga Hasil Dalam Negeri LHDN or the Inland Revenue Board of Malaysia IRBM. Lembaga Hasil Dalam Negeri Tax Relief History.

Other than e-Data Praisi and e-Filing e-E CP8D must be submitted in Excel or txt file format by sending an e-mail to CP8Dhasilgovmy.

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Ctos Lhdn E Filing Guide For Clueless Employees

Zenflex Lhdn E Filing Tools Otosection

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Ctos Lhdn E Filing Guide For Clueless Employees

Zenflex Lhdn E Filing Tools Otosection

Iincametaxncome Tax Lhdn Filing Taxes Income Tax Tax Guide

How To File Income Tax In Malaysia Using Lhdn E Filing Otosection

List Of Lhdn S Income Tax Relief For E Filing 2021 Ya 2020 Otosection

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Ctos Lhdn E Filing Guide For Clueless Employees